Let me go ahead and show you how we do a vertical analysis here on an income retained earnings statement and then you guys can get some practice on a balance sheet. In every single one of our calculations, the base amount is net sales for that year. So 2018, the base amount is always going to be and when we do 2017, it’ll always be 58081.

Marketplace Financial Model Template

Vertical analysis might be used in tandem with horizontal analysis to help spot patterns and maximize profits using data-driven strategies. Checking a company’s balance sheet, you’ll likely see the entire assets or liabilities listed as the initial amount. The common size Fraction is also useful for comparing businesses that operate in the same industry but use different currencies or those that operate in a completely different industry. The term vertical analysis came about when a downward straight analysis was done by looking for information in common-sized financial vertical analysis documents. Specifically, percentages from a vertical analysis may not always correspond to percentages of change.

Cash Flow Statement Key Lines

That means the variable expenses in the balance sheet of year 2 and 3 are shown as a percentage of variable expenses of year 1. Vertical analysis is the comparison of financial statements by representing each line item on the statement as a percentage of the total amount. You can perform the same calculation for the other cash flow statement items for a more comprehensive view of the company’s cash flow. Vertical analysis makes it much Grocery Store Accounting easier to compare and contrast the financial statements of different companies.

Exploring the Vertical Analysis of Operating Cash Flows

For example, cutting research and development costs might improve short-term margins but harm long-term growth. Regulatory frameworks, such as GAAP or IFRS, can also influence how certain expenses are reported, affecting comparability. This shows each cash outflow or inflow as a percentage of the total cash inflows of the business. Both techniques provide valuable insights for financial analysis and decision-making, but they serve different purposes and offer distinct perspectives on a company’s financial performance. Let us understand the differences through the comparison below.

Our income tax of 3,200, well that’s going to be, divided by the net sales is 5.5%, and finally, our net income. So we’re left with at the end of the day off of net sales of and we get 8.3%, okay? So this is a big part of the vertical analysis is that bottom line, right?

Drive Business Performance With Datarails

- By grasping the purpose, importance, and various components of vertical analysis, you can harness its full potential in financial analysis and decision-making.

- This will give you the percentage of that particular item as it relates to the total.

- Managers use this to compare a company’s financial performance over time.

- It categorizes cash flows into operating activities, investing activities, and financing activities.

- The vertical analysis formula is simply dividing each individual figure by your base amount, then multiplying the result by 100.

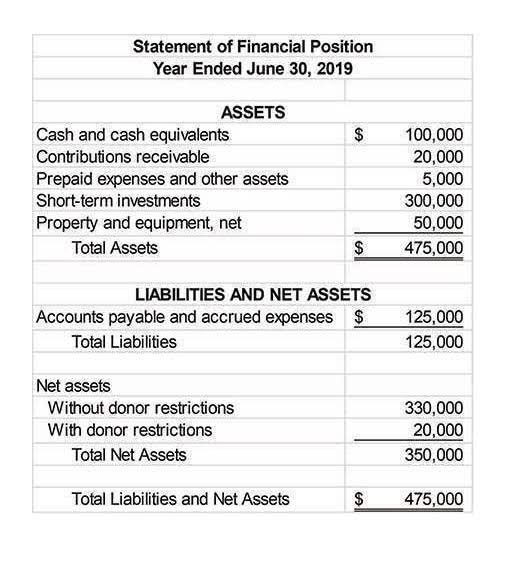

- Likewise, all the items in the balance sheet are stated as a percentage of the total assets.

Also, it’s far less of a hassle to evaluate similar businesses. Get started with premium spreadsheets and financial models customizable to your unique business needs to help you save time and streamline your processes. Read on as we take you through the basics of vertical analysis. This is 902 divided by our net sales of 58081, and let’s just keep going down. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

Key Takeaways

- Vertical analysis is a kind of financial statement analysis wherein each item in the financial statement is shown in the percentage of the base figure.

- The next one, well rent expense, it didn’t change year over year, 2411 but it’s coming out of less net sales, right?

- The base amount is usually taken from an aggregated from the same year’s financial statements.

- Remember to choose appropriate base figures, maintain consistency, and consider industry-specific factors to enhance the accuracy and relevance of your analysis.

- Therefore, it is important to see the total picture by combining horizontal and vertical analysis.

- Vertical analysis differs from horizontal analysis in that it focuses on the relationship of each line item to a base amount within a single financial statement, expressed as a percentage.

This would mean that the ratio of years 1, 2, and 3 to year one would be 100%, 97%, and 94%. In this example, the business’s variable expenses have trended downward over the three-year period. That is because this approach quickly reveals the proportion of various account balances reflected in the financial statements. In this FAQ we will discuss what vertical analysis is, how it relates to horizontal analysis, and provide a simple example of how to apply it. When compared to one another, the balance sheets of companies with values of one billion and half a million dollars might be difficult to interpret. Benchmarking and vertical analysis are two applications of the same core idea.

- Comparing this number with the previous year’s figure of 62.2% can help us gain insight into how the company manages its expenses.

- For the income statement, net sales serve as the base, while total assets and total liabilities and equity are used for the balance sheet.

- For example, through vertical analysis, we can assess the changes in the working capital or fixed assets (items in balance sheet) over time.

- Read on as we take you through the basics of vertical analysis.

- Expressing these items as percentages of total assets helps assess asset management efficiency and financial leverage.

- Vertical analysis is a method of analyzing financial statements.

Whether you’re considering cost-cutting measures, pricing strategies, or investment decisions, vertical analysis helps evaluate the potential impact on key line items. By analyzing these ratios using vertical analysis, you can evaluate a company’s financial position, leverage, and liquidity. Vertical analysis (also known as common-size analysis) is a popular method of financial statement analysis that shows each item on a statement as a percentage of a base figure within the statement. Discover how vertical analysis offers insights into financial statements, enhancing understanding of company performance and aiding strategic decision-making. The information provided in the balance sheet provides the change in working capital, fixed income over some time.